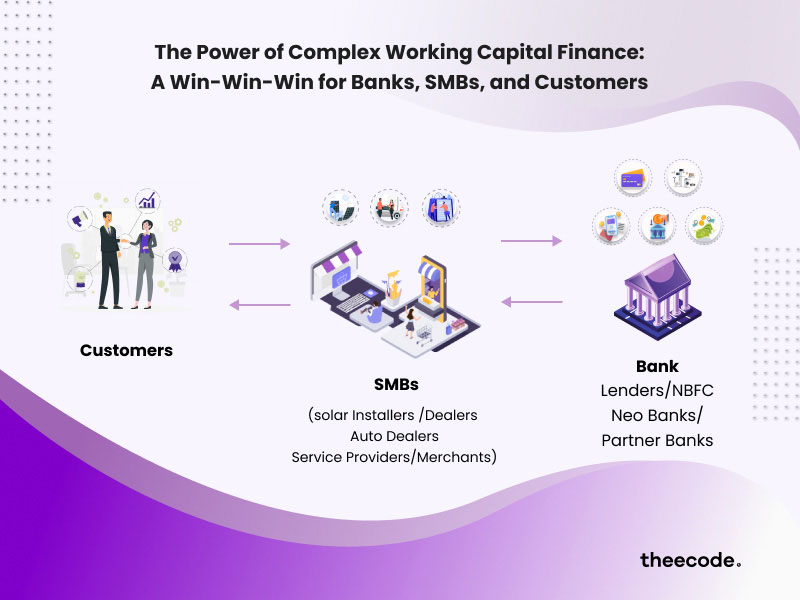

The Power of Complex Working Capital Finance: A Win-Win-Win for Banks, SMBs, and

Customers

Introduction

In today's dynamic business landscape, small and medium-sized businesses (SMBs)

are the driving force behind economic

growth. They contribute significantly to the development of local economies and

provide employment opportunities.

However, these SMBs often face financial challenges, particularly when it comes

to accessing working capital and

securing funds for growth.

At least 47% of start-ups and SMBs struggle or close their doors prematurely due

to a lack of access to capital. This is

a huge concern as around 50% of the USA's GDP is contributed by SMBs and it's

important for them to get the proper

support to keep thriving.

This is where the power of Complex Working Capital Finance comes into play,

creating a win-win-win scenario for lenders,

merchants, and customers. In this blog, we will delve into the advantages of

this approach and explore how it benefits

all parties involved.

What is Complex Working Capital Finance?

Complex Working Capital Finance refers to specialized financial solutions that

help

businesses manage their short-term

liquidity and operational expenses by lending parties and they benefit from it

by

selling their services while providing

the working capital. To better understand this concept, let's explore a

practical

example involving John, a small

business

Meet John, a solar panel installation provider who aims to expand his business

and

meet the growing demand for renewable

energy solutions. John's business involves procuring raw materials, managing

labour

costs, and ensuring timely

installations for his customers. However, he faces a common challenge among

small

businesses: securing sufficient funds

to scale his operations.

To overcome this challenge, John explores Complex Working Capital Finance

options

tailored to the solar industry. He

approaches a financial institution specializing in renewable energy financing,

which

offers him a line of credit

specifically designed for solar installers. This line of credit allows John to

access funds for purchasing raw

materials, paying labor costs, and expanding his installation capacity.

With the flexible financing provided through Complex Working Capital Finance,

John

can procure solar panels and related

equipment without compromising his cash flow. This enables him to fulfil

customer

orders promptly, enhancing customer

satisfaction and attracting new business opportunities.

Furthermore, John discovers that the financial institution offering the working

capital finance solution also provides

additional banking products and services. They offer him the opportunity to

partner

with them for his banking needs,

including opening business accounts, obtaining business insurance, and utilizing

their credit and debit card services.

By leveraging this cross-selling opportunity, John not only secures the funds

needed

for his solar installations but

also gains access to a comprehensive suite of financial products and services.

This

simplifies his financial management,

streamlines his business operations, and ensures a seamless experience for both

him

and his customers. But Complex

Working Capital Finance is not only beneficial for SMEs.

Let's delve into the benefits for Banks, SMEs and Consumers

Benefits for Banks

Cross-selling financial loans provides significant advantages for banks,

enabling them to expand their product offerings

and increase their market presence. By collaborating with various partners such

as NBFCs and other financial

institutions, banks can tap into new customer segments and target niche markets.

This strategic alliance allows banks to

diversify their revenue streams and strengthen their position within the

financial industry.

Through cross-selling loans, banks have the opportunity to deepen their

relationship with merchants. By understanding

the unique financial requirements of businesses, banks can offer customized loan

products that cater to their specific

needs. This personalized approach enhances customer satisfaction and fosters

long-term loyalty, resulting in improved

financial outcomes for both the bank and the merchant.

Moreover, cross-selling loans provide banks with an avenue to offer a

comprehensive suite of financial products and

services. By leveraging the lending relationship, banks can introduce merchants

to other banking products such as debit

and credit cards, insurance policies, business accounts, and more. This not only

increases customer engagement but also

generates additional revenue through cross-selling these supplementary

offerings.

Benefits for SMBs

SMBs stand to gain significant advantages from Complex Working Capital Finance.

Access to working capital and cash flow

is crucial for their growth and expansion plans. Whether it's a small

departmental store looking to expand its inventory

or a solar installer in need of funds for raw materials and labour, having

access to financing can be a game-changer.

Through Complex Working Capital Finance, merchants access a wider range of loan

options and funding sources. This allows

them to choose the most suitable loan product for their specific needs.

Additionally, cross-selling facilitates a

streamlined application and approval process, often with less stringent

eligibility criteria. This ease of obtaining

funds empowers merchants to focus on their core business activities and seize

growth opportunities.

Moreover, by partnering with Banks, SMEs can negotiate more favourable loan

terms and conditions. This can include lower

interest rates, flexible repayment options, and longer repayment periods. Such

benefits enable merchants to optimize

their cash flow and better manage their financial obligations.

Furthermore, Complex Working Capital Finance provides merchants with access to

capital and offers an opportunity to

strengthen customer relationships. By providing financing options such as

instalment payment plans, merchants can

enhance the purchasing power of their customers. This, in turn, leads to

increased sales and customer loyalty, as

individuals appreciate the convenience and flexibility of financing options.

Benefits for Customers

Customers or Consumers are the indirect but ultimate beneficiaries of Complex

Working Capital Finance. By availing of

these loans, Businesses enable customers gain access to the necessary funds for

various purposes. This financial support

boosts their confidence, enabling them to pursue their entrepreneurial

aspirations or make significant purchases.

With access to financing options, customers can effectively manage their cash

flow and mitigate the risk of financial

strain. For instance, in the case of residential solar installations, businesses

can secure loans not only for the

purchase of raw materials but also for labour costs. This comprehensive

financing solution ensures a seamless experience

for residential customers, encouraging them to embrace sustainable and renewable

energy solutions.

Moreover, Complex Working Capital Finance often introduces customers to a range

of additional banking products and

services which can be referred through the Business brand pages or direct

campaigns by lending institutions to end

consumers. Through this process, customers may be offered credit cards,

insurance coverage, deposit accounts, and

recurring payment options. This provides convenience and expands their financial

capabilities, enabling them to make

more informed decisions about their money and achieve their financial goals.

Conclusion

Complex Working Capital Finance has emerged as a powerful strategy that creates

a win-win-win scenario for lenders,

merchants, and customers.

-

Banks benefit from diversifying their revenue streams, expanding their

customer base, and strengthening customer

relationships.

-

SMBs gain access to much-needed working capital, favourable loan terms,

and the ability to offer flexible financing

options to their customers.

-

Customers, in turn, enjoy the convenience of financing options,

increased purchasing power, and a seamless experience in

achieving their goals.

GLENZY MAKES IT EASY!

Theecode's lending solution, GLENZY, plays a pivotal role. GLENZY caters to the

unique needs of SMBs, facilitating a

smooth B2B and B2B2C lending experience. The solution connects lenders with

multiple partner banks, streamlining the

loan application and approval process. This ensures that SMBs can access funds

efficiently and continue to grow their

businesses.

Additionally, GLENZY empowers merchants by providing them with greater control

over their operations. The solution

offers features that enable merchants to track installations, monitor customer

payments, and gain valuable insights into

their business performance. By providing transparency and convenience, GLENZY

allows merchants to optimize their

strategies and drive growth.

A Three-way win is the biggest triumph in every battle! Let us help you achieve

them quicker and faster through GLENZY!

To know more about GLENZY, write to

hai@theecode.xyz