Is FedNow a US Adaptation of UPI? Know the Difference

In recent years, digital payment adoption has become a global phenomenon,

prompting countries and states to strive for efficiency, speed, and

security. India's introduction of UPI in 2016 amazed many countries with its

effective technology, processing 2 billion transactions within four years.

Leveraging its experience in the Indian digital payments sector, Google has

made recommendations to the Federal Reserve, including real-time support for

low and high-value payments, standardized messaging protocols with extended

metadata, and the establishment of clear guidelines for an Application

Programming Interface (API) layer to allow third parties without financial

institution licenses to access and submit requests into the payment system.

Although the US financial market values privacy and security, it is taking a

step forward by launching FedNow in May/June 2023, a new payment system by the

Federal Reserve that enables instant payments and transfers 24/7. FedNow offers

a faster, more convenient, and accessible way for individuals and businesses to

make transactions.

Is FedNow a version of UPI in US?

-

UPI (Unified Payments Interface) and FedNow are both electronic

payment systems, but they operate in different countries and have

different underlying technologies.

-

UPI is a payment system developed by the National Payments

Corporation of India (NPCI) and is widely used in India. It allows users

to transfer funds between bank accounts instantly using a mobile app or

a web interface. UPI also supports other services such as bill payments,

merchant transactions, and fund requests.

-

FedNow, on the other hand, is a payment system developed by the

Federal Reserve of the United States. It is designed to provide

real-time payment capabilities for businesses and consumers in the US,

allowing for instant fund transfers 24/7. FedNow will be accessible

through banks and other financial institutions that are connected to the

Federal Reserve's payment system.

-

Let understand the difference between both the payment systems

-

Ownership: UPI is owned by the National Payments Corporation of

India (NPCI), which is a non-profit organization created by the Reserve

Bank of India and Indian Banks Association. FedNow, on the other hand,

is owned and operated by the Federal Reserve, which is the central bank

of the United States and works on profit.

-

Geographic Coverage: UPI is a payment system used exclusively

in India, while FedNow is a payment system used exclusively in the

United States. UPI was launched in 2016 by the National Payments

Corporation of India, and as of 2021, it is used by over 200 banks

in India. FedNow is still in development and is expected to launch

in May 2023.

Transaction Limits: UPI has transaction limits depending on

the bank and type of account. These limits may range from a few

thousand to a few lakh (hundred thousand) rupees per day. On the

other hand, FedNow has a default transaction limit till $100,000,

which can be adjusted a little up and down by the financial

institutions.

Payment Initiation:

UPI payments can be initiated using a mobile phone number or a

virtual payment address (VPA), which is a unique identifier linked

to a bank account. In contrast, FedNow payments are initiated using

the recipient's bank account number and routing number.

Transaction Fees:

UPI is a run by NPCI which is a non-profit organisation encouraging

every Indian to experience digital payments and increase the economy

focusing on maximum sign-ups for bank accounts. Let it be a

small-scale farmer or a vendor, UPI encourages everyone to access

its seamless and quick digital payments experience with ZERO

transaction cost. When it come on FedNow, their focus is on making

the transaction in real time as a convenience and premium to all the

existing account holders and charges a monthly fee of $25 per

routing transit number, a $0.045 fee per credit transfer, and a

$0.01 fee per request for payment message.

-

Use Cases:

UPI is primarily used for P2P payments, bill payments, and online

purchases within India. On the other hand, FedNow is designed for

instant payments between bank accounts in the United States, including

P2P payments, B2B payments, and government payments.

-

Technology:

UPI leverages the Immediate Payment Service (IMPS) infrastructure to

transfer funds instantly between bank accounts. Virtual Payment

Address (VPA) is a unique identifier that allows users to receive

payments without having to share their bank account details. The VPA

is linked to a user's bank account and is used to send or receive

payments. UPI also uses payment gateway technology to securely

process and authenticate transactions. Merchants and customers can

make seamless and easy payments using QR code technology. Overall,

UPI technology is designed to be fast, secure, and user-friendly,

making instant payments a breeze for users.

When it comes to Fednow, the system uses a modernized version of the

Automated Clearing House (ACH) system and the ISO 20022 messaging

standard to provide faster processing times and seamless integration

between different systems. It also incorporates a modernized

settlement process, utilizing a combination of central bank and

commercial bank money to enable almost instant availability of funds

to the recipient. Strong security features, including encryption,

authentication, and fraud prevention, are also included in the

system. Overall, FedNow represents a significant advancement in the

world of payments, providing faster and more efficient processing

times, and focuses highly on greater security and reliability.

-

Settlement speed:

UPI provides immediate payment transfers, while FedNow is a new payment

system under development in the United States that aims to offer faster

and more efficient payment processing. The difference in settlement time

may seem small, but it can have a significant impact on time-sensitive

payments and could potentially revolutionize payment processing in the

United States.

Now that we are clear that UPI and FedNow are similar in some

aspects but definitely not the same, let's look into the internal

process of how each payment is operated through these payment systems

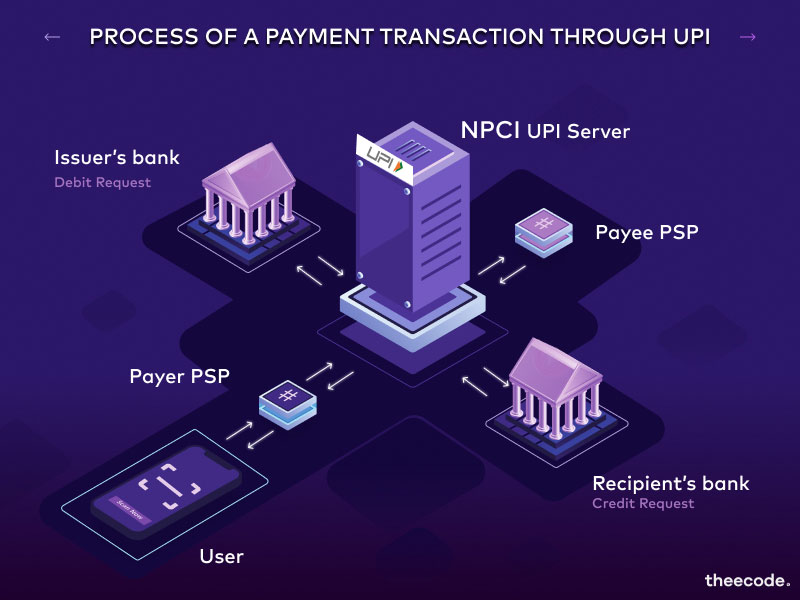

Process flow of a payment through UPI

- UPI allows users to instantly transfer money between

bank accounts using a UPI-enabled mobile app (Google Pay, Paytm, Amazon

Pay etc). Users link their bank accounts to the app, enter the

recipient's UPI ID, amount, and confirm the transaction with a UPI PIN.

The money is transferred instantly, and users can also pay bills,

recharge their mobile phones, and make other transactions directly from

the UPI app. Here is an example of how UPI works:

-

User initiates a transaction through the UPI-enabled mobile app.

-

The app sends a request to the PayeR's PSP (Google Pay, Paytm etc)

-

Payer's PSP authenticates the issuer's credentials and verifies the

transaction details.

-

The platform sends a request to the user's bank to debit the specified

amount from their account.

-

The bank verifies the request and debits the issuer's account.

-

The bank sends a confirmation message to the Payer's PSP, which then

forwards it to the issuer's app.

-

Payee's PSP sends a request to the recipient's bank to credit the

specified amount to their account.

-

The recipient's bank verifies the request and credits the specified

amount to the recipient's account.

-

The recipient's bank sends a confirmation message to the Payee's PSP,

which then forwards it to the recipient's app.

-

Both the sender and recipient receive a notification on their respective

UPI-enabled apps confirming the transaction.

-

The entire process takes only a few seconds, and the transaction is

completed instantly. The UPI platform acts as an intermediary between

the two banks, ensuring secure and seamless transactions.

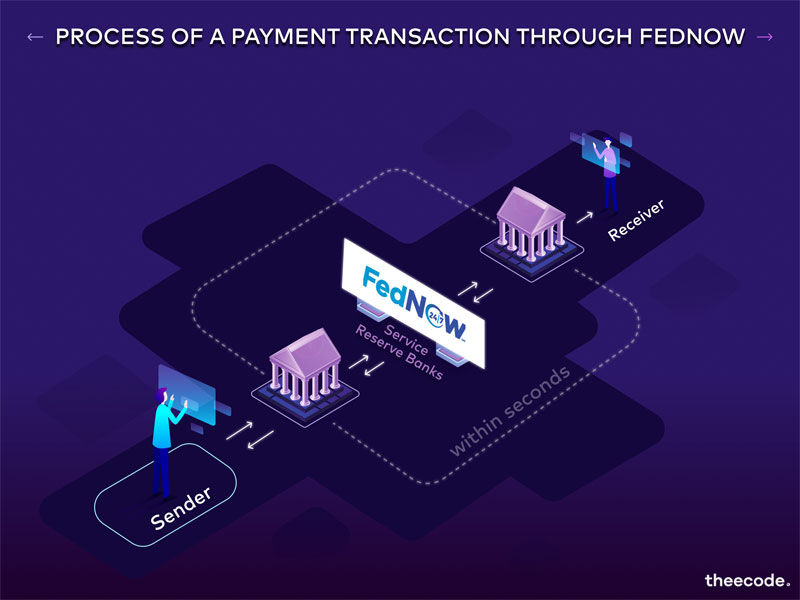

On the other hand, In FedNow when a payment is initiated, the sender's financial

institution uses the FedNow Service to send the payment instruction to the

receiver's financial institution. The receiver's financial institution then

credits the receiver's account in real-time, settling the payment. To use the

FedNow Service, financial institutions must enroll and be approved by the

Federal Reserve Banks, meet technical and operational requirements, and can

access the service directly or through a service provider. Here is an example of

how FedNow works:

-

Initiation of Payment: A sender initiates a payment request through

their financial institution's FedNow Service interface. The sender enters

the payment amount, recipient information, and other relevant details, such

as payment instructions or a reference number.

-

Payment Validation: The FedNow system validates the payment details

to ensure that all necessary information is present and accurate. The system

also checks to ensure that the sender has sufficient funds to cover the

payment.

-

Payment Authorization: Once the payment is validated, the FedNow

system authorizes the transfer of funds from the sender's account to the

recipient's account.

-

Settlement: The FedNow system settles the payment by transferring the

funds from the sender's account to the recipient's account in real-time. The

recipient's financial institution is notified of the payment and the funds

are made available immediately.

-

Payment Confirmation: The FedNow system sends a confirmation message

to both the sender and the recipient to confirm that the payment has been

completed.

-

Payment Reconciliation: The financial institutions involved in the

payment reconcile their records to ensure that the payment has been properly

credited and debited.

In conclusion, the launch of FedNow by the Federal Reserve of the United States

marks a significant milestone in the country's quest for a more efficient,

faster, and secure payment system. While many have compared FedNow to India's

UPI, it is clear that both systems are fundamentally different. As the world

moves towards digital payments, FedNow is poised to offer users a more

accessible and convenient way to make transactions in the US. With the promise

of real-time payments 24/7, FedNow is set to revolutionize the way businesses

and individuals make payments.

Do you think FedNow has the potential to make impact on the payment systems like

UPI did?

In your opinion, which one will emerge victorious: UPI or FedNow?