How can a Lender utilize LMS to Enhance Lending Operations?

The lending process may seem simple on the surface - a borrower requests a

loan, undergoes verification, receives approval from the lender and then

repay the principal amount along with interest. However, in large financial

institutions with numerous entries and active loans, streamlining the

process can become cumbersome. That's where Loan Origination Systems (LOS)

come in - by digitizing the lending process, borrowers can be easily

onboarded, undergo KYC and underwriting, and generate and accept offers.

This saves time and resources by reducing the need for manual paperwork and

documentation.

However, while LOS helps streamline loan applications, something is needed

to manage the entire process from fund dispersion to amortization and

repayment. Without a cloud-based Loan Management System (LMS), it can be

chaotic to manage everything manually. An LMS can help manage the entire

process, allowing for smoother operations and better tracking of loan

progress.

What is Loan Management System (LMS)?

-

Let's say you are a teacher who needs to manage a class project and

you might use a system to keep track of which students have chosen

which topic, how much time each student has to work on their

project, and when each part of the project is due. You might also

need to communicate with students to provide feedback and guidance

and ensure that the project is completed on time and within budget.

-

In this case, the Loan Management System would be the software and

processes you use to manage the entire project lifecycle, from

initial planning to final submission. It would include features such

as tracking of project status and progress, and communication tools

to keep students and other stakeholders informed.

-

Similarly, A loan management system is a platform that enables

lenders to manage their loan portfolios and automate the loan

servicing process. It includes a range of features such as loan

approval and disbursement, repayment schedules, and tracking of loan

payments and balances. The system also provides reporting and

analytics capabilities that enable lenders to monitor and analyse

the performance of their loan portfolios, identify trends, and make

data-driven decisions. Overall, a loan management system helps

lenders to streamline their operations, reduce costs, and improve

the customer experience.

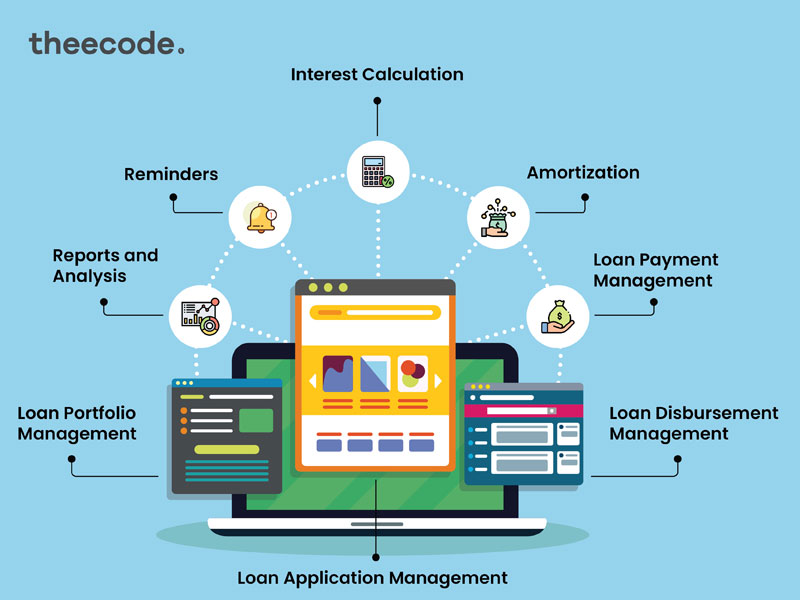

Features of a Loan Management system:

- Loan Application Management: The LMS helps lender to

streamline and automate the loan approval process based on their

criteria. It allows lenders to easily review and analyze the

borrower's financial information, which helps them make informed

decisions on loan approvals or rejections.

-

Loan Disbursement Management: Once the loan has been

approved, it's time to get the funds to the borrower. The loan

management system manages the entire disbursement process, which

includes verifying the applicant's information and then transferring

the funds. This is where the borrower finally gets to breathe a sigh

of relief and say, "I got the loan!

-

Amortization: It's basically a way of paying off a loan over

time through regular payments. Each payment goes towards both the

principal amount borrowed and the interest charged on that amount.

As the borrower makes these payments, the amount going towards the

principal gradually increases while the amount going towards

interest decreases. LMS creates a super-organized table that

outlines the specific amounts and timing of each payment. This way,

you can see exactly how much debt is paid off each time.

-

Loan Payment Management: Ah, the joy of paying back loans!

Well, maybe not, but it's an essential part of the loan management

process. LMS manages loan payments, which includes tracking them,

generating invoices, and sending reminders to borrowers when their

payment is due. Our LMS also offer multiple payment methods like

Stripe and account-to-account payment providers like Modern

treasury. This ensures that borrowers can make payments in a way

that's convenient for them.

-

Interest Calculation: Interest is the cost of borrowing

money, and it's an essential component of any loan. LMS also

calculates interest based on the loan amount, interest rate, and

repayment period and commits zero errors. This ensures that both the

borrower and the lender are on the same page regarding the cost of

the loan.

-

Differing Payment Management: Sometimes, borrowers might want

to pay off their loan early or make extra payments. The loan

management system allows for differing payments, such as providing

the option to make extra payments to pay off the loan early or ask

for an extension for a particular payment. This ensures that

borrowers have some flexibility in how they repay their loans.

-

Reports and Analysis: The loan management system generates

reports on loan applications, disbursements, payments, etc. This

allows lenders to stay on top of their loan portfolio and make

informed decisions.

-

Customer Relationship Management: The loan management system

allows the management of customer information, including

communication with borrowers and tracking of interactions. This

ensures that lenders can build a relationship with their borrowers

and provide them with a high level of service.

-

Loan Portfolio Management: Managing a portfolio of loans can

be a daunting task. The loan management system assists with the

management of the loan portfolio, including tracking loan

performance, delinquencies, and defaults. This ensures that lenders

can monitor their loan portfolio and take corrective action if

necessary.

Why does every lender need an LMS?

-

Time-saving: LMS saves lenders time by automating many of the

loan management processes. For example, loan applications can be

submitted online, and the system can automatically process the

application, verify credit scores, and approve or reject the loan.

Furthermore, it effectively manages all the loans portfolio under a

single interface until the loan is repaid. This saves lenders from

having to manually review and manage each loan application, which

can be time-consuming.

-

Easy Access: LMS provides lenders with easy access to loan

information from anywhere, at any time. This allows lenders to

manage their loan portfolio and respond to customer inquiries

quickly and efficiently, without the need for physical documents.

-

Centralized Data: LMS centralizes loan data, providing

lenders with a single source of truth for all loan-related

information. This makes it easier to manage and analyse loan data,

generate reports, and identify trends and patterns that can inform

business decisions.

-

Flexibility: LMS can be customized to suit the needs of

different types of lenders like banks, NBFC etc and different

sectors of lending like automobile, healthcare etc. This makes it a

flexible solution that can be tailored to meet the specific

requirements of each lender.

-

No errors: The process of manually computing loan interest

rates for each loan application can be overwhelming and prone to

errors due to human fallibility. However, utilizing software such as

LMS streamlines the process and conducts all computations and data

analysis without any mistakes.

-

Systematic repayment process: LMS provides lenders with a

streamlined repayment process that automates payment reminders,

generates payment schedules, and tracks borrower payments, ensuring

timely payments and reducing the risk of default. There is no worry

about making calculation mistakes or tracking payment schedules, LMS

solves it all.

The financial market today requires credit products that can cater to

various demands such as quick loan processing, flexible and scalable options

for both lenders and borrowers, as well as robust cybersecurity and

compliance measures. Digital loans are becoming increasingly popular, and a

high-quality Loan Management System can handle these requirements, providing

a positive lending experience and customer-centric platforms that businesses

are seeking. Incorporating professional Loan Management Software in their

business strategy can enable companies to target new generations of

customers while streamlining their workflows.

Theecode offers the industry-leading Loan Management Solution, providing a

suite of Lending Solutions that meet various needs for your specific

vertical of lending be it automobiles, home improvement or healthcare.

Theecode currently works with, different Financial Institutions, lenders and

dealers worldwide, ensuring access to the best-in-class solutions for

customers' needs.