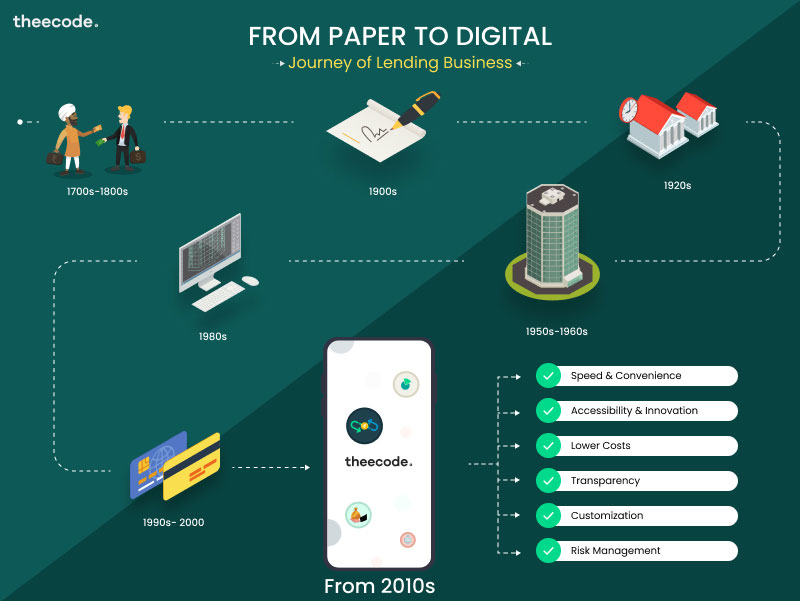

From Paper to Digital - Journey of Lending Business

The lending business has come a long way from paper-based processes to digital

lending platforms. In the past, getting a loan was a cumbersome and

time-consuming process. The borrower had to visit the lender's office multiple

times, submit a pile of documents, and wait for days or even weeks for the loan

to be approved. However, with the advent of digital technology, the lending

process has become much simpler and faster.

The timeline of the loan process across the decades

-

1700s-1800s: The earliest recorded loans were provided by

pawnbrokers and moneylenders who would lend money against collateral.

These loans were typically small and short-term and were provided to

individuals who were unable to access traditional banking services.

-

1900s: The modern lending industry began to take shape with the

emergence of consumer finance companies, such as Household Finance

Corporation and Beneficial Finance Company. These companies provided

loans to consumers who did not have access to bank loans or credit

cards.

-

1920s: The first credit bureaus were established to track

consumer creditworthiness. The most famous of these was Equifax, which

was founded in 1899 as a credit reporting agency for the mercantile

industry.

-

1950s-1960s: Banks began to play a larger role in the lending

industry, offering loans to consumers and businesses. This was made

possible by the introduction of credit scoring, which allowed banks to

assess the creditworthiness of borrowers more accurately.

-

1980s: The securitization of loans began to gain popularity, as

lenders packaged loans together and sold them to investors. This allowed

lenders to generate more liquidity and reduce risk.

-

1990s: The internet began to emerge as a viable platform for

conducting business, and online lenders such as E-Loan and LendingTree

began to emerge.

-

2000s: The financial crisis of 2008 had a significant impact on

the lending industry, as lenders tightened their lending standards and

many traditional lenders went out of business. This created an

opportunity for digital lending platforms to emerge, such as LendingClub

and Prosper, which leveraged technology to connect borrowers with

investors.

-

2010s-present: The digital lending industry continued to grow

and evolve, with the introduction of new products and services such

as peer-to-peer lending, crowdfunding, and mobile lending apps. The

rise of blockchain technology has also opened up new possibilities

for the lending industry, with the emergence of decentralized

lending platforms such as SALT and ETHLend.

With the rise of digital lending platforms, the loaning process has

become even more streamlined and efficient. Borrowers can apply for

a loan online, provide their documentation electronically, and

receive a loan decision within minutes. The use of big data and

machine learning algorithms has also enabled lenders to make more

informed lending decisions and reduce the risk of default.

As technology progressed, lenders started adopting computerized

systems to manage their lending processes. This involved digitising

the application process and using software to automate various

aspects of the loan underwriting process. However, these systems

were still largely reliant on paper-based documentation, and

borrowers still had to physically submit their documents to the

lender's office.

The real revolution in lending came with the advent of digital

lending platforms. These platforms are essentially online

marketplaces that connect borrowers with lenders. Borrowers can

apply for a loan online, upload their documents electronically, and

receive a loan decision within minutes. Lenders, on the other hand,

can access a large pool of potential borrowers and use advanced

algorithms to underwrite loans quickly and accurately.

Key benefits of the switch from paper to digital lending platforms:

- Speed and Convenience:

Digital lending processes are typically much faster and more convenient

than traditional lending processes. Borrowers can apply for loans online

from anywhere, at any time, and receive a loan decision within minutes

or hours, rather than days or weeks.

-

Accessibility: Digital lending platforms have made it easier for

underserved borrowers, such as those with thin credit files or low

credit scores, to access credit. By using alternative data and machine

learning algorithms, digital lenders are able to make more informed

lending decisions and provide loans to borrowers who may not have been

able to get approved by traditional lenders.

-

Lower Costs: Digital lending platforms are often able to offer

lower interest rates and fees than traditional lenders, due to their

lower overhead costs and more efficient loan processing.

-

Transparency: Digital lending platforms typically offer more

transparency into the lending process, providing borrowers with clear

information about interest rates, fees, and loan terms.

-

Customization: Digital lending platforms are often able to offer

more customized loan products that are tailored to individual borrowers'

needs. By leveraging big data and machine learning, lenders can better

understand borrowers' financial situations and offer loan products that

are better suited to their needs.

-

Risk Management: Digital lending platforms are often able to

better manage risk by using advanced analytics and machine learning

algorithms to assess borrowers' creditworthiness and identify potential

defaults before they occur.

-

Innovation: Digital lending platforms are often at the

forefront of innovation in the lending industry, using new

technologies such as blockchain and artificial intelligence to

develop new products and services that are more efficient, secure,

and user-friendly

However, there are also some challenges associated with digital

lending. One of the main challenges is the need to ensure data

privacy and security. Digital lending platforms collect and store a

large amount of personal and financial information, and there is a

risk of this information being compromised. Lenders need to invest

in robust security measures to protect their borrowers' data

Another challenge is the need to ensure fair lending practices.

Digital lending platforms use algorithms to underwrite loans, which

can sometimes result in unintended biases. For example, if the

algorithm is trained on historical data that reflects existing

preferences in the lending system, it may perpetuate those biases.

Lenders need to be vigilant and ensure that their algorithms are

fair and unbiased.

Coping up with the modernisation of lending while making sure ist

highly secure, safe and efficient can be a tough battle to be in. It

makes it equivalently important to choose the right technology to

streamline your entire lending process. Theecode technologies are a

reliable and efficient platform for digital lending, especially when

it comes to addressing the challenges associated with data privacy,

security, and fair lending practices. With its focus on implementing

robust security measures to protect borrowers' sensitive information

and ongoing efforts to monitor and adjust algorithms to avoid

unintended biases, Theecode technologies take proactive steps to

tackle the challenges of digital lending.

However, it is worth noting that the digital lending industry is

constantly evolving, and new challenges may emerge over time.

Therefore, Theecode remains vigilant and stays up-to-date with the

latest developments in the industry to ensure that we are providing

a safe and fair lending experience to our customers.

Fast, Efficient, and Secure lending with Theecode