B2B2C business model in Lending

Running a successful business is no easy feat, and there are many factors that

can hinder its success. In the lending industry, this is especially true, with a

crowded market and ever-changing customer expectations. To maintain a

competitive edge and continuously grow, businesses must explore innovative

solutions and models that can help them acquire new customers in a sustainable

and scalable way.

B2B (business-to-business) and B2C (business-to-consumer) are two common models

used to describe how companies sell their products or services. B2B refers to a

model where businesses sell their products or services to other businesses. In

terms of lending, this could mean that a lending company provides their lending

solutions to other businesses, such as banks or financial institutions, who then

offer those solutions to their customers (individual borrowers). This model is

popular in the tech industry, where companies offer software or other tech

solutions to help businesses improve their operations or infrastructure. Custom

solutions tailored to individual business needs are also common in the B2B tech

space.

On the other hand, B2C refers to a business strategy where companies sell their

goods or services directly to individual customers. In terms of lending, this

could mean that a lending company provides their lending solutions directly to

individual borrowers, without the involvement of any other business. Businesses

that use the B2C model prioritize creating products that are easy to use,

feature appealing design and marketing, and gather customer data to enhance

their offerings.

What is B2B2C Business Model?

-

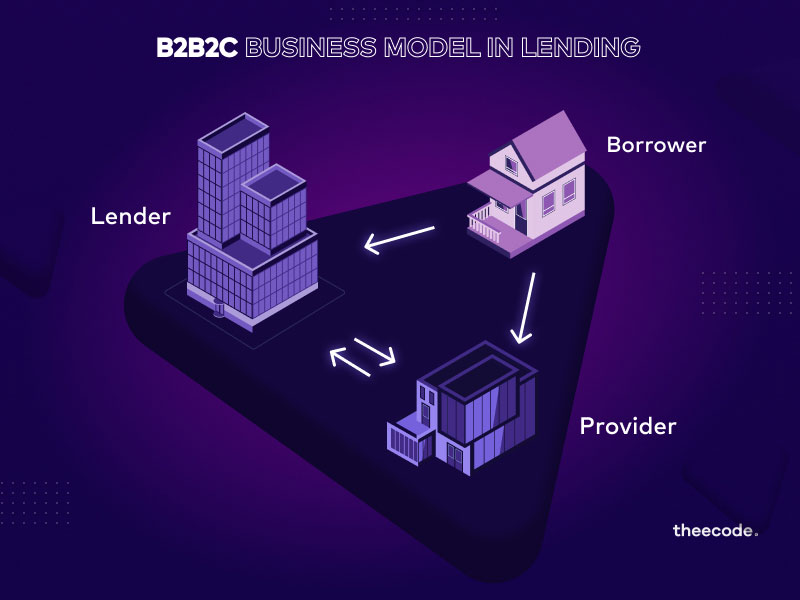

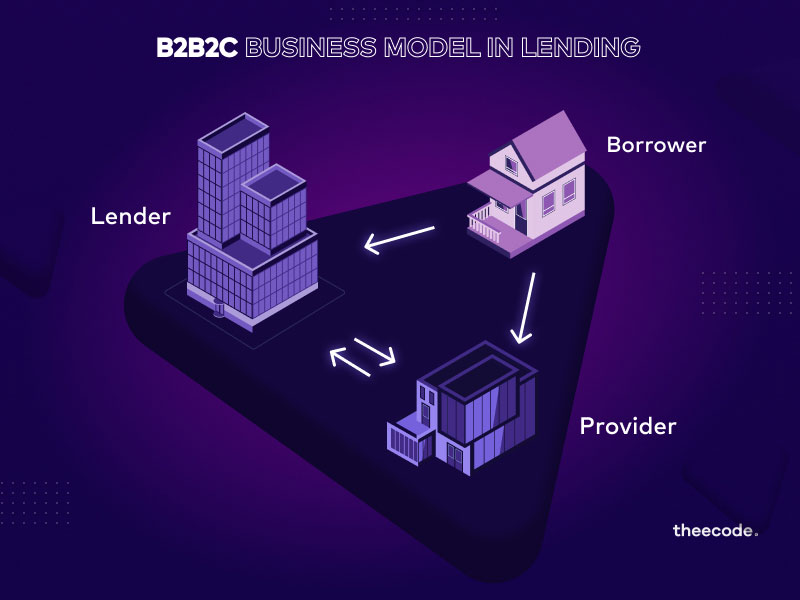

Now, let's talk about the B2B2C model in the lending industry. This

model involves lending companies collaborating with other businesses

(B2B) to offer their lending solutions to individual borrowers (B2C).

For example, a lending company may partner with a provider to offer

lending solutions to its customers. The provider benefits from offering

additional lending services to their customers, improving their customer

experience and loyalty, while the lending company benefits from reaching

a larger customer base and reducing operational costs and risk.

-

The B2B2C lending model can also help lending companies develop more

innovative lending solutions, knowing that their partner businesses are

responsible for delivering those solutions to their customers. This

allows lending companies to focus on their core competencies and choose

efficient product development solutions catering to that specific niche

while leveraging their partner businesses' existing customer base and

marketing efforts.

-

Furthermore, the B2B2C lending model can help to reduce operational

costs and risk for the lending company, as it doesn't have to directly

manage customer relationships or marketing activities. It also enables

lending companies to focus on developing/ sourcing innovative lending

solutions and improving their services, knowing that their partner

businesses are responsible for delivering those services to their

customers.

How do lenders use the B2B2C model to enrich provider's and borrower's

experiences?

For providers:

- The lenders provide providers with the opportunity of increasing the

purchasing power for the customers by catering to the customer base who

require loans right from the provider's portal for convenience

-

Providers get a boost of sales through lenders by adding a lending

feature as a form of payment, but they are liable to limited risk as the

lender is responsible for the background check, KYC, and underwriting

and bares all the risk if the loan isn't repaid leaving provider with

higher sales and minimal/no risk.

-

Loan finance process options can be quickly and easily integrated into a

provider's existing checkout process. The lender takes care of the

complex backend processing and approvals as the provider acts as an

intermediary.

-

Lender typically offers a user-friendly interface that is easy to

navigate and understand for both the provider and the consumer. The

interface can also be customized to fit the look and feel of the

provider's website or app.

-

The lender minimizes/eliminates the need for the provider to employ

staff to manage financing operations. This saves time and money, as the

third-party provider takes care of all the backend processes, from

processing applications to manage repayments.

For borrowers:

-

A B2B2C lending model can help the borrowers in reducing the middleman

and directly apply for a loan and choose the provider of the service/

product or choose the provider and directly seek a loan through them.

-

The lenders make the entire process too efficient and easy for borrowers

which saves them time and resources. No more waiting in lines for hours

or submitting hundreds of documents with the aspiration to get your loan

approved.

-

Instead of waiting for days to get your loan to process and verify your

profile, lenders with digital solutions make the decision in a few

seconds.

-

A seamless lending process can offer customers greater flexibility in

terms of loan amounts, repayment terms, and other features. This means

that customers can find a financing solution that meets their specific

needs and budget.

-

Lenders provide customers with greater transparency in terms of fees,

interest rates, and repayment schedules. This allows customers to make

informed decisions about their financing options and avoid hidden or

unexpected costs.

How do you start with your B2B2C lending business?

-

At theecode, we recognize the potential of the B2B2C lending model and

offer solutions that can help lenders succeed in this space. We provide

lenders with a specialized lending platform that can be customized to

meet their business clients' and end consumers' specific needs.

-

Our product enables lenders to offer loans or credit to businesses, who

in turn can use the funds to offer loans or credit to their customers.

This enables businesses to offer financing options to their customers,

thereby improving customer loyalty and increasing sales.

-

In addition, theecode provides lenders with data analytics tools to help

them assess the creditworthiness of potential borrowers and make

informed lending decisions. This can help lenders mitigate risks

associated with lending to businesses and consumers. Theecode simplifies

the process of reporting and analyzing loan applications for lenders,

providers, and borrowers by providing comprehensive information that is

easily accessible and organized, facilitating documentation and

tracking.

“One size doesn't fit all.”

At Theecode we have a hybrid approach to this famous saying and which is why we

are among the leading Hybrid SaaS lending solution providers. We offer specific

solution products tailored to your niche while also constructing a common

sandbox that seamlessly fits into the vertical. We have identified several top

verticals with outstanding lending opportunities and developed a customized,

free-to-access sandbox for you to test before committing to the lending

business.

-

Automobiles lending solutions

-

-

The automotive industry is experiencing a significant shift in

revenue streams, with on-demand mobility services and data-driven

services diversifying the market and creating new opportunities.

This change could generate up to $1.5 trillion in additional revenue

potential in 2030, representing a 30% increase from traditional car

sales and aftermarket products/services. The growing demand for

electric vehicles is also contributing to the expansion of the

global automotive finance market, which was valued at USD 259.84

billion in 2022 and is expected to register a compound annual growth

rate (CAGR) of 7.3% from 2023 to 2030.

-

However, for many individuals, the traditional lending process can

be a barrier to owning a car. The tedious paperwork, collateral

requirements, lengthy loan approval times, and high-interest rates

can make the process overwhelming and take away from the joy of this

significant milestone. In the US, Experian's State of the Automotive

Finance report highlights that the growing demand for electric

vehicles is driving market growth, with new electric vehicle

financing increasing from 1.34% in Q4 2019 to 4.56% in Q4 2021.

-

At Theecode, we understand that owning a vehicle is more than just

transportation; it's a symbol of your achievements and a lifelong

dream for many. That's why we offer hassle-free lending solutions to

lenders that make it easier for borrowers to purchase the vehicle

they want.

-

Our technology solution for lenders provides efficient auto

financing, prioritizing convenience. We streamline the lending

process, allowing borrowers to apply for loans, receive offers

within seconds, and sign documents digitally. Lenders disburse funds

to providers, and borrowers pay back loans in instalments with

interest to lenders. With us, one can experience the joy of owning a

vehicle without the stress of a complicated lending process.

- Theecode makes a B2B2C model in automobile lending a WIN- WIN

-WIN model.

-

Healthcare lending solutions.

-

-

We've all heard the saying "Health is Wealth," but sometimes

unforeseen accidents or a lack of prioritization can leave us in a

situation where we require medical attention. However, medical bills

can be exorbitant, and while medical insurance covers many essential

health alignments, it may not cover certain clinical surgeries like

dental, plastic, eye, cosmetics etc.

-

Overall, the healthcare industry is expected to reach $11.9 trillion

by 2025, and healthcare lending is a critical component of this

growth. The global healthcare lending market is projected to reach

$372.7 billion by 2028. Healthcare lending enables patients to

access medical treatments they might not have been able to afford

otherwise, and partnering with lenders can help healthcare providers

drive revenue growth and improve patient outcomes.

-

Theecode offers a customized solution for healthcare providers that

allows them to offer on-site loan applications to patients, which

can be approved and processed within minutes. This helps patients

afford necessary medical treatments and can increase sales for

healthcare professionals, while also allowing lenders to expand

their customer base and disburse more loans.

-

Our product offers user portals for lenders, providers, and

borrowers, loan dispersal methods, and loan initialization, with a

health vertical sandbox that provides free access to explore lending

in the health domain. Our solution is designed to provide a

streamlined and convenient lending process, benefiting all parties

involved.

-

Solar installation lending solutions

-

-

In 2021, the global solar energy systems market size was valued at

USD 160.3 billion. It is expected to grow at a compound annual

growth rate (CAGR) of 15.7% from 2022 to 2030.

-

The increasing use of solar panels in the European region,

particularly in countries like Spain and Italy, which receive

maximum sunlight exposure throughout the year, is expected to drive

the market. The U.S. emerged as the largest market for solar PV

panels in North America in 2021.

-

These numeric data points highlight the significant growth potential

of the solar energy market, particularly in the coming years. As the

demand for sustainable energy production sources continues to grow,

so does the demand for solar energy systems and solar PV panels. The

declining costs of solar energy systems, combined with their

competitive nature in the energy generation industry, are further

fueling this growth.

-

At Theecode, we are dedicated to crafting a streamlined B2B2C

process that delivers lenders an exceptional and seamless interface,

connecting all involved parties. Our state-of-the-art technology

solutions facilitate solar installation providers to extend loans to

their customers, thereby boosting their sales and promoting

environmental sustainability. Simultaneously, our platform is

designed to provide borrowers with a hassle-free and expeditious

loan application process, which instils confidence and enables them

to make a smooth transition to solar power. We take pride in

offering customized solar lending solutions that are efficient and

user-friendly for all stakeholders involved.

Conclusion:

The 3 verticals, Automobiles, healthcare and solar installations can make a

breakthrough in the lending industry, especially with its B2B2C model. Just like

in B2B, this model allows for specialization by targeting providers and

leverages the benefits of B2C to build a loyal customer base. If you're hesitant

about taking a big step into this business, you can take advantage of our

Embedded Lending Framework for free and explore your expertise in these

verticals in just 60 seconds.

“Unleash the potential of your business with B2B2C - the ultimate fusion of B2B

and B2C models.”